The Oracle of Wall Street: How One Analyst Called the 2025 Crash

In the wake of the devastating “Black Monday” market crash on April 7, 2025, a name is circulating with increasing urgency among investors and financial analysts. Before the chaos erupted, an obscure market analyst with a small, independent research firm published a series of remarkably accurate predictions that foreshadowed the market’s dramatic downturn.

Uncanny Foresight

The analyst’s reports, released in the weeks leading up to the crash, detailed a confluence of factors that they believed would trigger a significant market correction. These included:

- The Impending Tariff Announcement: They specifically highlighted the potential for new US tariffs to destabilize global trade and create widespread market panic. Their analysis accurately predicted the timing and general scope of the tariffs.

- Growing Market Overvaluation: They pointed to the inflated valuations of many tech stocks and the unsustainable pace of market growth, warning of an inevitable correction.

- Increasing Geopolitical Uncertainty: They stressed the rising tensions between major economic powers and the potential for these tensions to disrupt global markets.

- The “Ripple Effect”: The analyst also correctly predicted the speed with which the market downturn would spread, and the level of impact that would be felt across all major markets.

A Lone Voice

What makes these predictions particularly striking is that they were largely dismissed by mainstream financial analysts. Their warnings were often labeled as overly pessimistic and alarmist. However, their detailed analysis and the precision of their predictions have now earned them a reputation as a modern-day oracle.

The Aftermath and the Questions

The “Black Monday” crash has validated the analyst’s analysis, prompting a wave of questions:

- How did they see what others missed?

- What analytical methods did they employ?

- What are their predictions for the market’s recovery?

- What other future market shifts do they foresee?

Investors are now scrambling to access their research and seeking their insights into the future of the market. While their methods are still somewhat shrouded in mystery, their track record speaks for itself. They had released some of their models publicly, but most did not understand the importance of the data.

A New Era of Market Analysis?

This analyst’s emergence raises the possibility of a new era in market analysis, one where independent research and unconventional thinking play a more prominent role. In a world increasingly dominated by complex algorithms and high-frequency trading, their ability to accurately predict market behavior highlights the enduring value of human insight and critical thinking.

As the market grapples with the fallout from “Black Monday,” all eyes are on the analyst who saw the storm coming.

Here is the video from 29 March 2025

See how they predicted the market, even before market crashed.

- (0:00 - 0:06) “US Stocks SHOP, PLTR Show Sudden PUT Movement. Full Scan of Key Support Levels (Includes Escape Coordinates).” Followed by disclaimer and intro slides.

- (0:07 - 0:17) Introduction: The speaker will discuss some popular US stocks that many people like to trade.

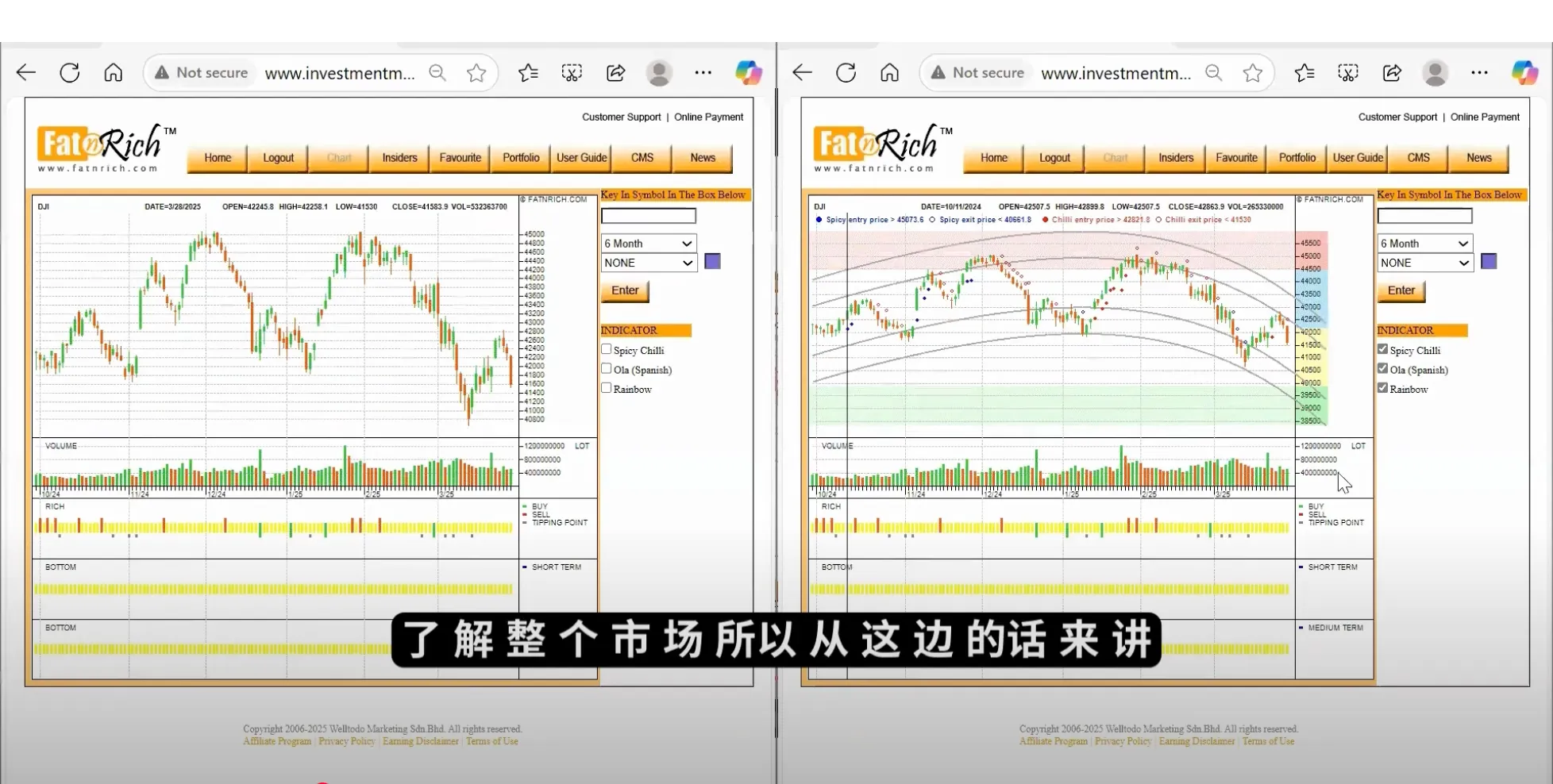

- (0:18 - 0:34) Reference to Previous Video: The speaker refers to a video made about two weeks prior analyzing US stocks, specifically the Dow Jones (DJI).

- (0:34 - 1:15) Dow Jones (DJI) Analysis Recap: Shows the chart analysis from the previous video, explaining how they identified highs and lows, predicting a potential rise from a low point and then a fall from a high point.

- (1:15 - 1:34) Accuracy Check & Market Overview: Confirms the previous analysis was accurate. Moves on to look at the current market situation using their indicators.

- (1:34 - 2:21) Current Market Situation (CMS): Explains the CMS indicator bars. Blue (Market Down) is currently high for NYSE and NASDAQ, indicating weakness. AMEX and OTCBB show mixed signals with some recovery (green) and uprising (red) alongside weakness (blue).

- (2:21 - 2:57) DJI Chart Comparison: Compares the previous DJI analysis chart (using their software “Insiders”, right side) with the actual subsequent chart (standard candlestick, left side). Shows how their software predicted the rise after the low (marked by 4 red candles previously) and the subsequent fall.

- (2:57 - 3:44) Insiders vs. Standard Chart (DJI): Emphasizes that their Insiders chart clearly showed the low, predicted the rise, and then the fall, while the standard chart (left) is harder to interpret for highs and lows.

- (3:44 - 4:41) Stock-Specific Analysis Intro: Transitions to analyzing specific stocks popular with traders, starting with SHOP.

- (4:41 - 5:15) SHOP Analysis: Compares standard chart (left) with Insiders chart (right) for SHOP. States the Insiders chart clearly shows the uptrend, high point, subsequent downtrend, and potential for further fall, which is difficult to see on the standard chart. Explains how the red (high) and green (low) zones and sell signals work.

- (5:15 - 5:53) SRAD Analysis: Shows analysis for SRAD using the Insiders chart. Identifies the high point, sell signal, and downtrend. Again contrasts the clarity with the standard chart and how it aids decisions like short selling.

- (5:53 - 6:28) CMPO Analysis: Shows CMPO using the Insiders chart. Notes it’s currently mid-downtrend and hasn’t reached the green (low) support zone, indicating potential for further decline. Highlights that standard charts don’t provide this clarity. Claims their Insiders software with AI technology is unique globally.

- (6:28 - 6:59) PLTR Analysis: Shows PLTR using the Insiders chart. Identifies highs and lows, indicating a potential downward move is starting from a high point. Explains how to use this for trading, including options/short selling.

Some information may be outdated