Gold’s Glittering Gains: What’s Fueling the Rally?

Gold, often seen as a safe-haven asset, has been attracting significant attention recently. Its price has been on an upward trajectory, leaving many investors wondering if they’ve missed out on a golden opportunity. So, what’s behind this surge? Several factors are likely at play:

- Persistent Inflation Concerns: Even with recent efforts to curb rising prices, inflation remains a significant concern globally. Gold has historically been used as a hedge against inflation, as its value tends to hold up better than fiat currencies during periods of economic uncertainty.

- Geopolitical Instability: The current global landscape is marked by various geopolitical tensions and uncertainties. In times of crisis, investors often flock to safe assets like gold, driving up demand and prices.

- US Dollar Weakness: The price of gold often has an inverse relationship with the US dollar. A weaker dollar can make gold more attractive to investors holding other currencies.

- Central Bank Policies: Expectations surrounding future interest rate hikes and other monetary policies by central banks can also influence gold prices.

- Safe Haven Demand: Beyond specific events, gold’s long-standing reputation as a store of value and a safe haven during economic downturns continues to attract investors seeking to protect their capital.

The Million-Dollar Question: Is It Too Late to Buy Gold?

This is the question on many investors’ minds. While past performance is not indicative of future results, analyzing the current situation can offer some insights:

- Potential for Further Gains: If inflation remains elevated, geopolitical risks persist, or the US dollar weakens further, there could be more upside for gold prices.

- Risk of Correction: Like any asset, gold is not immune to price corrections. Factors such as unexpectedly strong economic data, aggressive interest rate hikes, or a resolution of geopolitical tensions could lead to a pullback.

- Long-Term Perspective: For investors with a long-term horizon, gold can still play a valuable role in diversifying a portfolio and providing a hedge against systemic risks. Short-term price fluctuations should be viewed within this broader context.

Considerations for Potential Investors:

If you’re considering adding gold to your portfolio, here are a few things to keep in mind:

- Risk Tolerance: Understand your own risk appetite and how gold fits into your overall investment strategy.

- Diversification: Don’t put all your eggs in one basket. Gold should be part of a well-diversified portfolio that includes other asset classes.

- Investment Options: You can invest in gold through physical bullion (bars and coins), gold ETFs (Exchange Traded Funds), or gold mining stocks. Each option has its own advantages and disadvantages.

A Fork in the Road

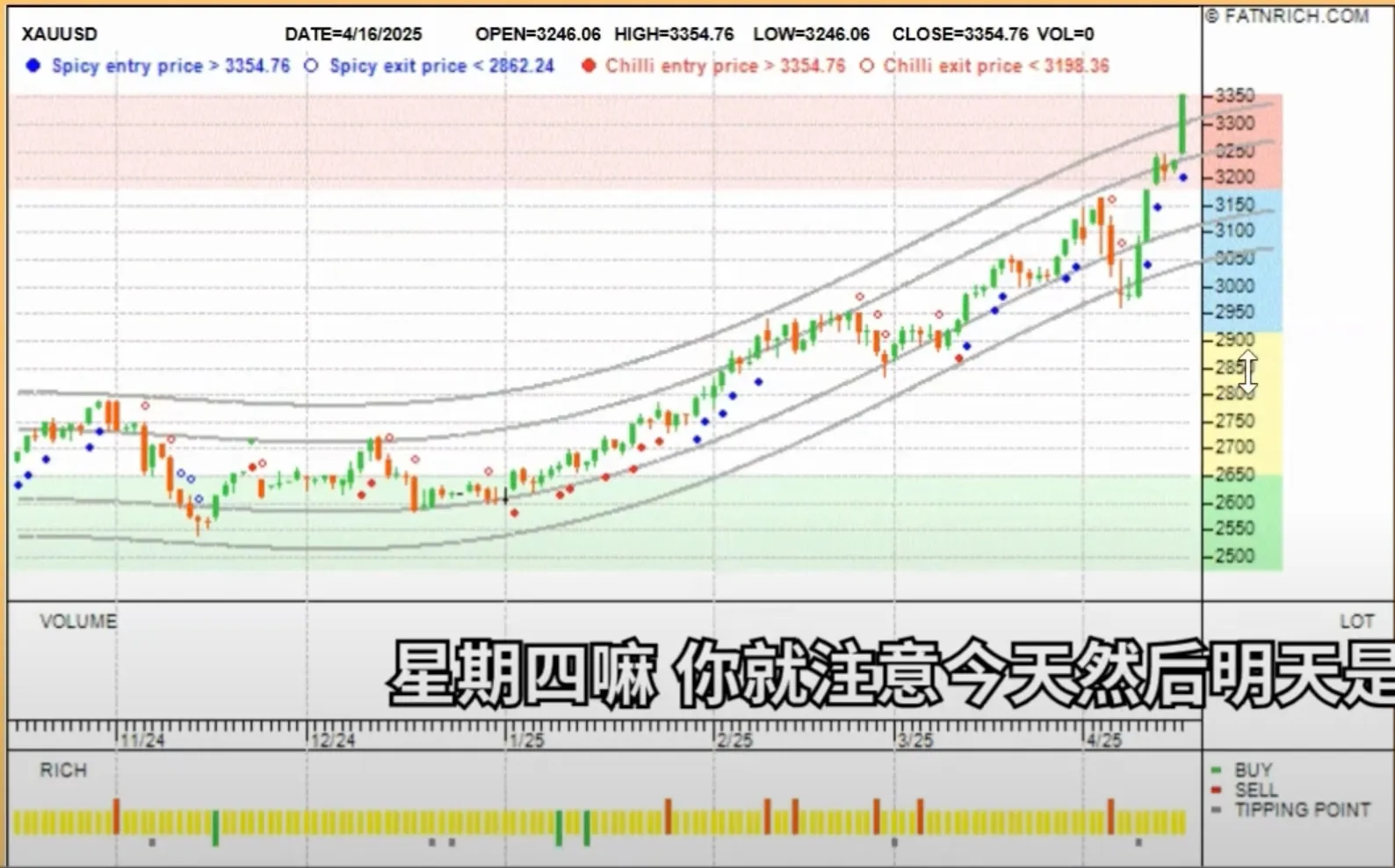

One investor predicted that the XAUUSD price might face a significant correction after its meteoric rise, citing potential profit-taking by traders. This perspective was shared in a YouTube video by FatnRich Investing, posted on 17 April 2025, which highlighted their own EA4 Robot Signals (Non-Repaint Long Short Arrow) and direction indicator suggesting a possible pullback. As of today, 25 April 2025, the XAUUSD price has indeed dropped from its recent peak, aligning with this prediction and reflecting the volatile nature of the gold market.

Trading Implications from the Video

- Exceeding the OLA upper band is presented as a reason for caution over the next 1-2 trading days (specifically the following Monday, as Friday is Good Friday).

- This situation might indicate potential profit-taking or a pullback.

- The appropriate action depends on the trading strategy:

- Long-term traders might have different considerations.

- Day traders should be particularly watchful for potential shorting opportunities if the price remains above the OLA band.

Conclusion: Endless Journey

While it is hard to believe what you just saw, this might be the fork in the road, where investors makes money and some losses money. Given the brevity of life and the seemingly endless journey of existence, the pursuit of continuous learning is not merely an option, but a fundamental necessity for growth and understanding.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

Some information may be outdated